How To Protect Your Account

Download Our Mobile App

Abacus Bank will NEVER request through email, text, or unsolicited phone call your bank card number, account number, Social Security number, Personal Identification number (PIN) or password.

- Abacus Mobile Banking

- Mobile Check Deposit

- Mobile Banking FAQs

Abacus Mobile Banking

Abacus Mobile banking1 is an easy, fast, secure and free2 service for Abacus Federal Savings Bank customers.

It is easy to bank right from your iPhone®, Ipad®, or Android™ anytime, anywhere. You can easily view account balances and transaction history, make check deposit, transfer funds between your Abacus Bank accounts and pay bills right on your mobile device.

To start, just sign on with the same User ID and Password you use to access your accounts online. It is safe and secure as it is protected by encryption technology.

Main Features and Comparison Chart

- Check balances

- Make check deposit3

- View transactions

- Pay bills4

- Transfer funds between eligible accounts

Mobile Banking Comparison Chart

| Features | Mobile Banking App | Mobile Website |

| Deposit Checks3 | Available | _ |

| Check balances | Available | Available |

| Review Transaction History | Available | Available |

| Transfer Between Accounts | Available | Available |

| Pay Bills4 |

Available | Available |

| Image of Cleared Checks | Available | Available |

| Received Alerts | - | - |

| Find Closest Branch or ATM | Available | Available |

There are 2 ways to access our mobile services:

- Mobile Banking App: our mobile app via iPhone®, Ipad®, or Android™ devices give you fast and easy access to your account and main banking features like bill pay, funds transfer and mobile check deposit3.

Simply scan the QR code below or search for "Abacus Bank" in the App Store or Google PlayTM to download the application:

ios Android

Download our mobile apps:

- Mobile Website: You can access to your Abacus Banking account anytime and anywhere. Simply go to abacusbank.com on your mobile browser to access your Abacus Bank account.

Mobile Check Deposit3

Mobile Check Deposit is a feature of our mobile banking app and is available to our mobile banking clients. It allows you to take a picture of a check and deposit it to an Abacus Bank’s personal checking, savings and Money Market account, all using your mobile devices.

Please make sure your check should be endorsed as:

x For Mobile Deposit at Abacus Bank Only

x Your signature(s)

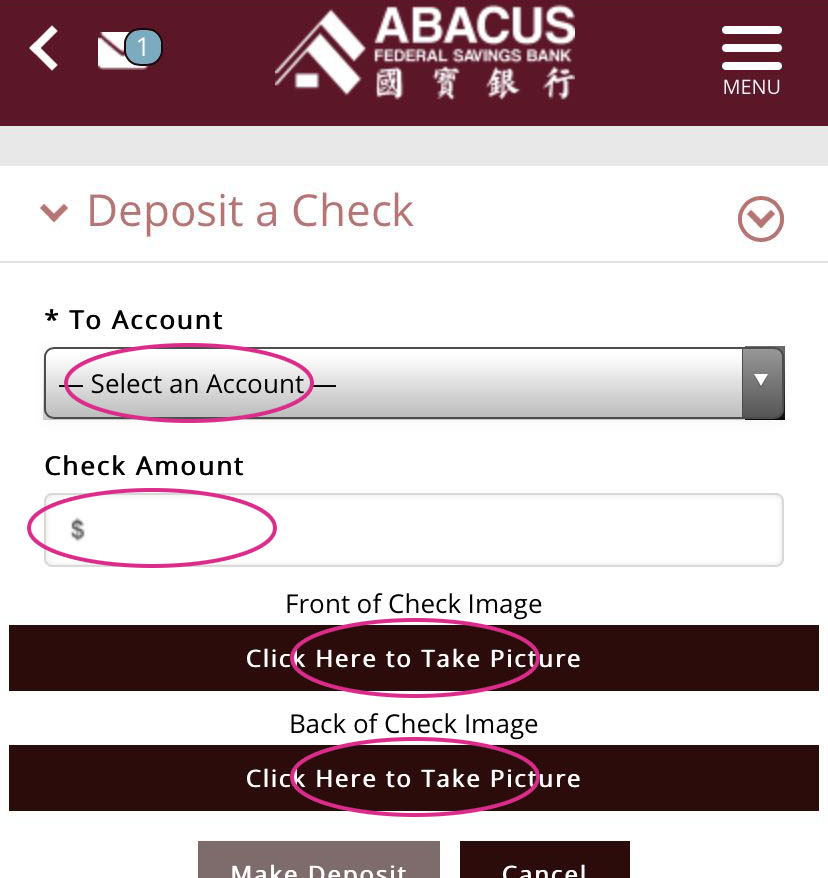

| Steps | Instructions | Images |

| 1 |

Download the Abacus Bank Mobile App

|

|

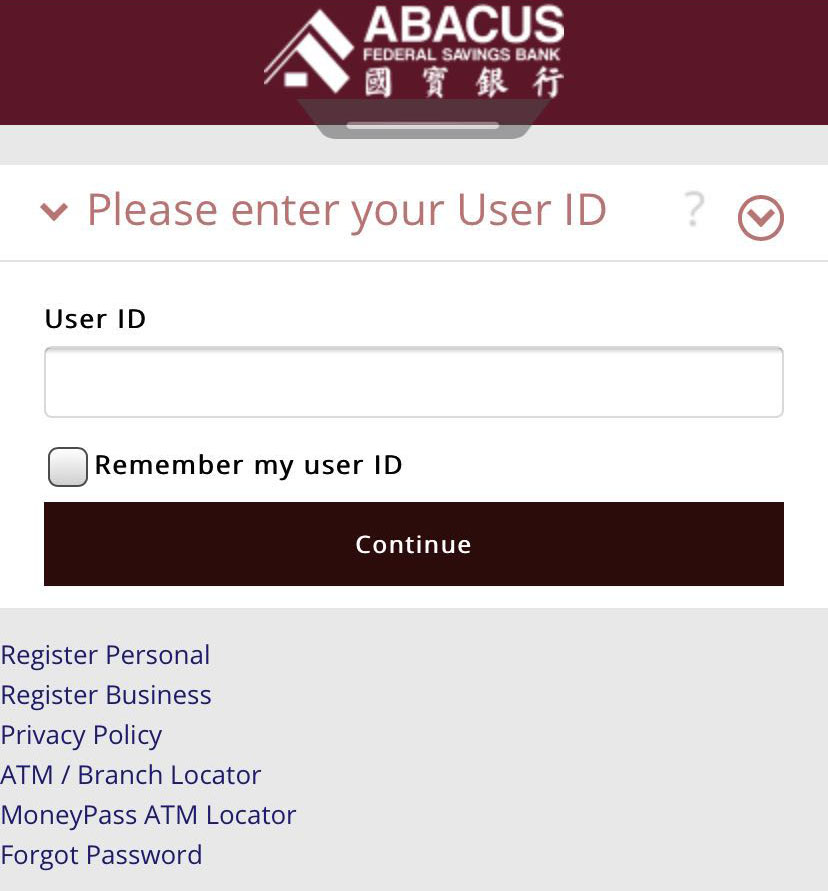

| 2 | Enter your user name |  |

|

3 |

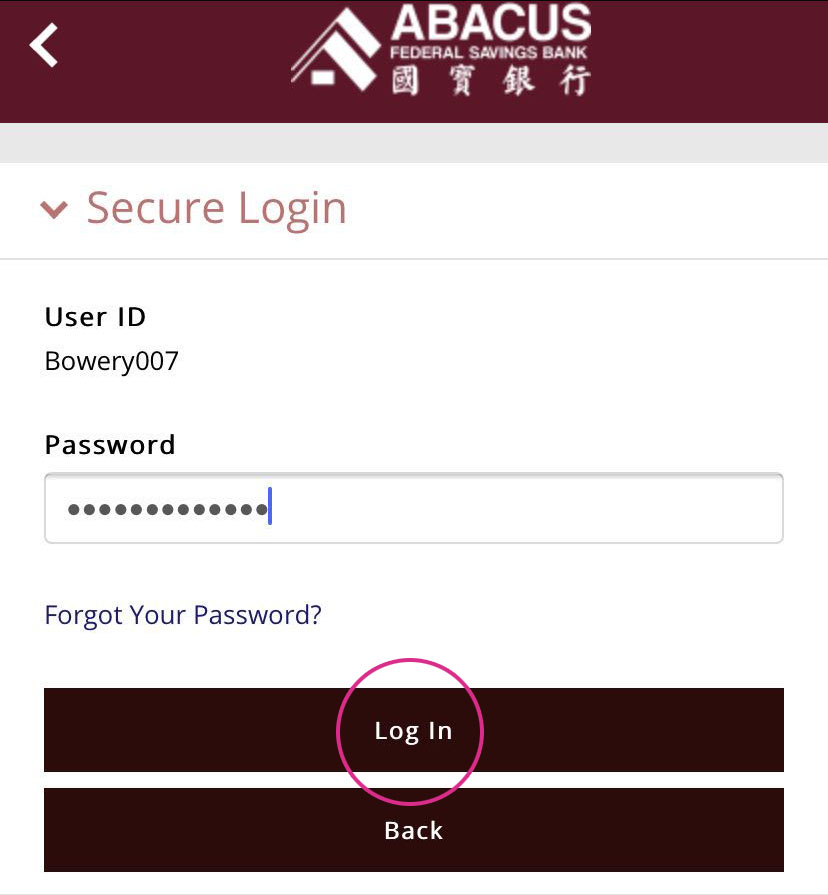

Enter your password then select "Log In" |  |

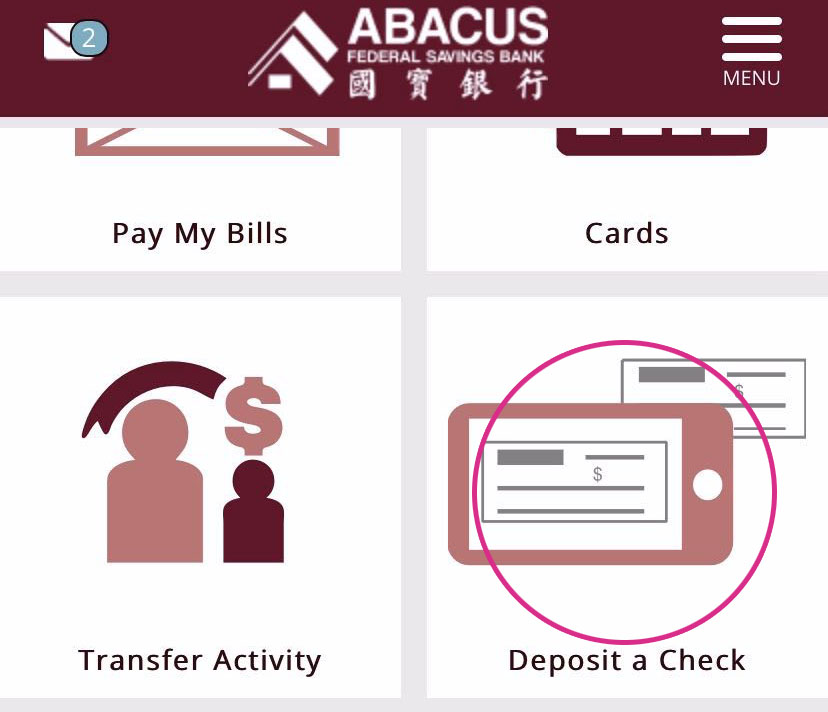

| 4 | Select "Deposit a Check" |  |

| 5 |

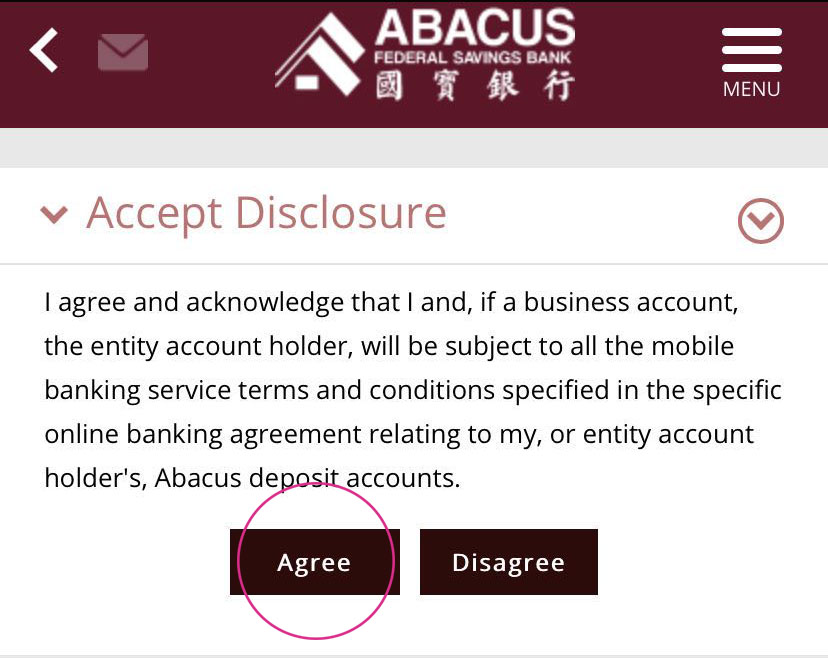

Accept Disclosure - Mobile Remote Deposit Services Agreement |

|

| 6 |

Deposit a check

|

|

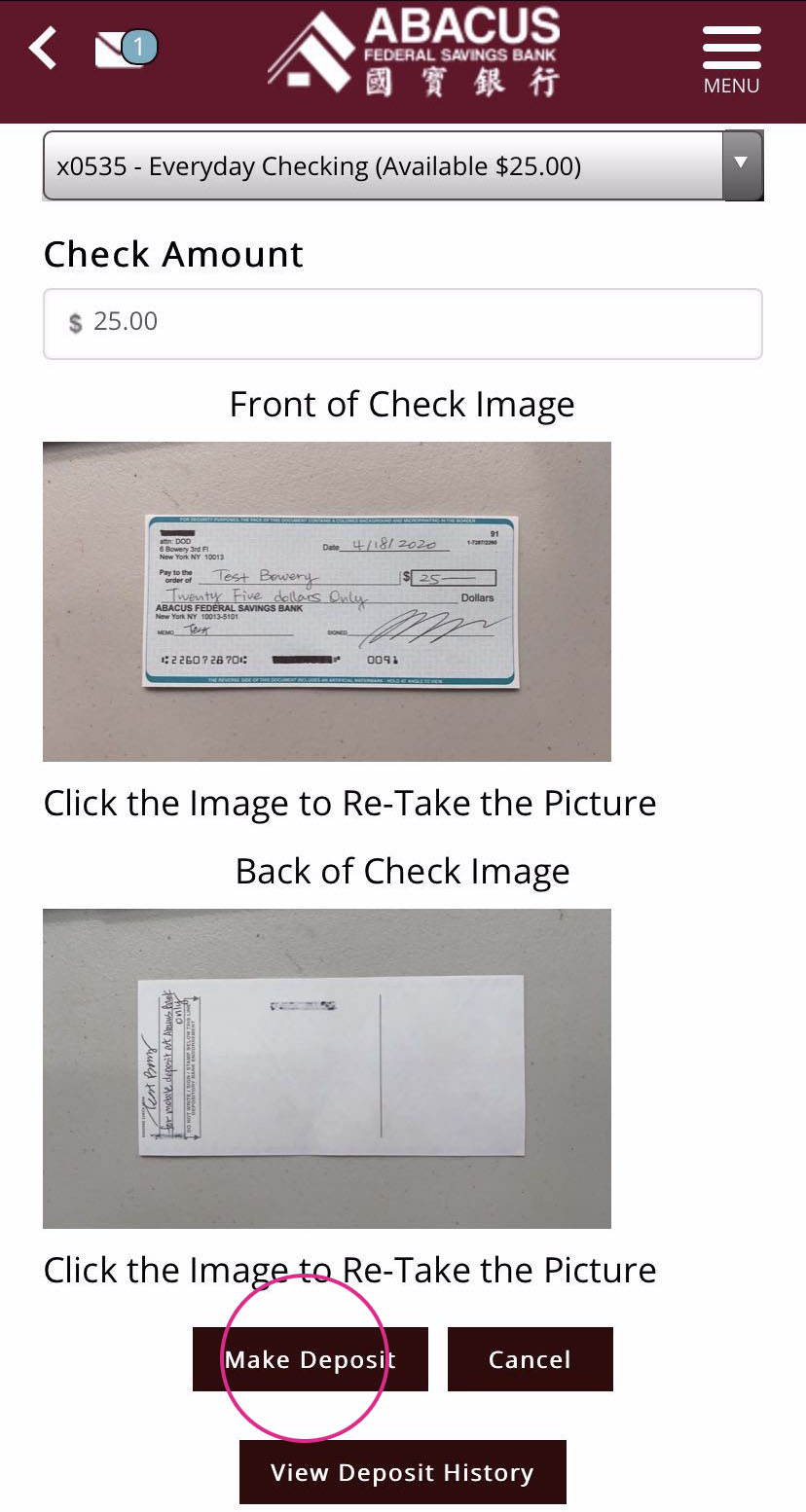

| 7 |

Deposit a check(continued)

|

|

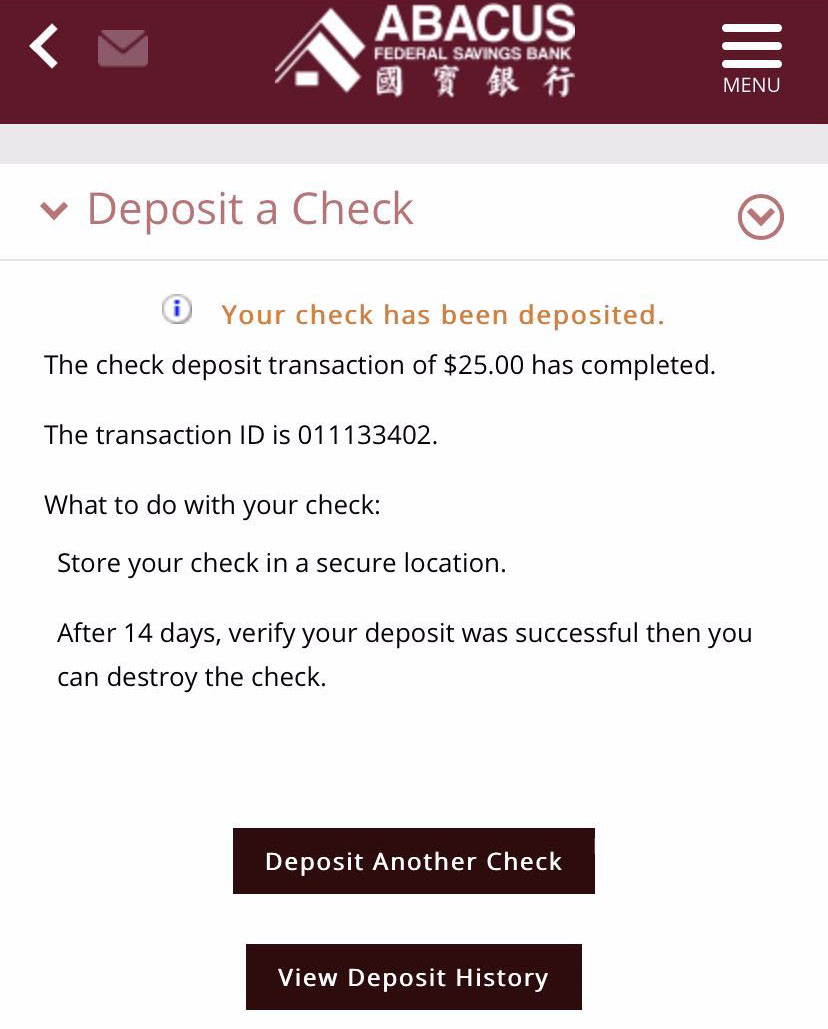

| 8 |

Complete successful deposit

|

|

Mobile Banking FAQs

General Mobile Banking FAQs

How many ways to access Abacus Bank Mobile Services?

- Mobile Banking App - our mobile app via iPhone®, Ipad®, or Android™ devices give you fast and easy access to your account and main banking features like bill pay, funds transfer and mobile check deposit3.

- Mobile Website - You can access to your Abacus Banking account anytime and anywhere. Simply go to abacusbank.com on your mobile browser to access your Abacus Bank account.

How can I enroll in Mobile Banking?

For security purposes, you MUST be enrolled in Abacus Bank Online Banking to access account information and perform banking transactions. To use Mobile Banking App and Mobile Website, you simply need to enter your Online Banking credentials. No separate enrollment required. If you use Text Banking services, log in to your Online Banking account and activate your mobile phone number. If you’re not already an Online Banking user, you can enroll online now.

How much does Abacus Bank Mobile Banking cost?

There are no fees to use or access Abacus Mobile App, mobile website, or text banking. Please check with your wireless provider about carrier and web access charges.

Is Abacus Bank Mobile Banking secure?

Abacus Bank’s Mobile Banking offers the same security and encryption as our Online Banking service. This helps ensure that your Mobile Banking experience with us will be safe and secure.

Will I be able to access all of my accounts using Mobile Banking?

Abacus Bank's Mobile Banking allows you to access all accounts that you currently view within Online Banking.

What should I do if I lose my phone?

Immediately report the loss or theft of your mobile device to your mobile carrier so that they can deactivate your phone.

For our Mobile Apps and the Mobile Web, we require a User ID and password and no information is stored on your mobile device, your information is safe. You are also automatically logged out after a short period of inactivity – 5 minutes on the Mobile App and 5 minutes on the Mobile Website.

If you use Text Banking services, you can go to the Mobile Banking & Alerts page within internet banking and select the Deactivate link that's next to your mobile phone number. That will terminate the service for the mobile device. You can always return later and Activate a new phone.

Mobile Check Deposit3

What is Mobile Check Deposit service?

Mobile Check Deposit is a feature of our mobile banking app and is available to our mobile banking clients. It allows you to take a picture of a check and deposit it to an Abacus Bank’s personal checking, savings and Money Market account, all using your mobile devices.

Who can use Abacus Mobile Check Deposit service?

Use of Abacus Mobile Deposit service requires that customer:

- has an internet enabled iPhone®, iPad, and Android™ device with a camera.

- is enrolled in our Online Banking Service and have downloaded our latest version of Mobile Banking app.

- must be a customer of Abacus Bank greater than 60 days with an active checking, savings, or money market account.

- The minimum balance in accounts meets the product minimum balance.

- have no more than two returned deposited items in the past two months. Deposit limits and other conditions may apply.

Which mobile devices can use Mobile Deposit?

- For Apple devices: requires iOS 9.0 or later. Compatible with iPhone, iPad, and iPod touch.

- For Android app: requires Android 5.0 and up

- Users must have also accepted the latest application update from their respective app store for Mobile Check Deposit to be available. Some older mobile devices may not work with Mobile Check Deposit.

Can I take photos of my checks and deposit them later using Mobile Check Deposit?

No, you cannot upload photos of your checks taken outside of the Abacus Bank mobile app. You must take the photos of your checks while the app is in use.

How does Mobile Check Deposit work?

Sign on to your Abacus Mobile app then follow these simple steps:

1. Contact bank at 212-285-4770 ext.2888 to get access to Mobile Check Deposit service. Wait about 2 business day to get approval.

2. If approval is still pending, you will see message “Please contact bank at 212-285-4770 ext. 2888 about eligibility for this service”

3. Once your Mobile Check Deposit is approved, for first time attempt to access check deposit feature on Mobile App, EUA (End User Agreement) will appears. You must accept EUA in order to use RDC service.

4. you may start using it by following steps:

a) Select an Account.

b) Enter an amount for the check in question using the number keypad of your mobile device.

c) Start taking check picture by click on camera icon

d) After you took the picture, you have following options:

i.Retake the picture: will take a picture of the front of check again.

ii.Keep Picture: will take you to the next screen.

5. Review the front image of the check. If all edges show and the amount is visible. Check image is nice and clear, click “Keep Picture”.

6. Capture the back image, make sure you have correct endorsement – For Mobile Deposit, your account# and your signature.

7. Review the front and back image of a check and click on “Deposit”.

8. Complete successful deposit. You will receive a confirmation message on your mobile device for each successful deposit. Plus, we’ll send a deposit confirmation to your primary email address.

9. Review your account the next day to see the fund has been posted to your account correctly. After you confirmed the deposit is correctly posted to your account, write VOID on the front of the original checks, keep it for 14 days and then securely destroy it.

Note: Do not VOID the check after submittal in the event the deposit is not approved and needs to be re-submitted.

What guidelines should be followed when submitting a check for Mobile Deposit?

We recommend you follow these guidelines:

- Endorse the check with your (the accountholder's) Account Number, signature and mark it "For Mobile Deposit Only".

- Be sure to include all four corners of your check and all edges show and the amount is visible; images that are "blurry" cannot be accepted.

- The dollar amount you enter when making the deposit must match the amount on the check.

Note: Some checks can be rejected due to poor photo quality, unusual formats, or layout or background features on the check. In these cases, Abacus Bank reserves the right to reject such Mobile Deposits and cannot be held responsible for its inability to accept a deposit via mobile banking.

What are the common errors in depositing checks?

- Folded or torn check corners.

- Unclear images of the front of the check.

- Amount entered does not match the check.

- Unclear bank routing and check account numbers.

- The images of the check are too dark.

Are there deposit limits for Mobile Check Deposits?

Yes. Mobile Deposits are limited to $1,500 per day, with a rolling 7-day limit of $5,000 and a rolling 30-day limit of $7,500. Limits are established and changed from time to time depending on customer profile and various risk factors, and Abacus Bank may raise or lower these limits without prior notice to you.

What types of items can I deposit?

You may deposit domestic checks to a personal checking, savings or Money Market account.

We are unable to accept International Checks, US Post Money Orders, Traveler’s Checks, Foreign Items, Savings Bonds, or Third Party Checks through Mobile Check Deposit.

Are there any fees to use Mobile Check Deposit?

Abacus Bank charges no fees to use the Mobile App. However, you should contact your wireless service provider to see if there are any access or usage fees that may apply. Fees noted in your Abacus Bank Online Banking and Account Agreements still apply.

When will my deposit be available?

The first $200 of total deposits made by 3:00 p.m. ET on any business day will be available on the next business day after the day you made your deposit. The rest of the deposited funds will be available by the second business day after the day you made your deposit. However, we may delay your access based on other factors we determine at our sole discretion.

For example, if you deposit a check of $700 on a Monday before the cut-off time, the first $200 of the deposit is available on Tuesday. The remaining $500 is available on Wednesday.

How do I know if the deposit was successful?

Deposits are shown in the Abacus Bank mobile app as you make them and will appear in your deposit history. To confirm that your mobile deposit transactions have been posted to your account, you may review the account detail of the account into which you made your deposit using your monthly statement or by signing on to Online Banking or with the Abacus Bank mobile app.

Is Mobile Deposit Safe?

Abacus Bank’s Mobile Deposit offers the same security and encryption as our Online Banking service. We use advanced encryption technology and security policies to safeguard the information being communicated between your device and the bank:

- Online Banking credentials are not stored on your mobile device.

- Check images are not stored on your mobile device.

- 128-bit SSL encryption masks your sensitive information.

- Your access ID and password must be entered before accessing the Mobile Deposit feature.

Related Links:

Personal Online Banking Agreement (PDF)

1 Abacus Mobile Banking services are available to Abacus Online Banking customers only.

2 Your mobile carrier's message and data rates may apply.

3 The deposit is accepted subject to verification. Deposits may not be available for immediate withdrawals. Other restrictions may apply. Please see Mobile Remote Deposit Service Agreement for details. Mobile Check Deposit is currently available on iPhone®, iPad®, and Android™ phones and tablets. The mobile Check deposit is currently not available for Amazon Kindle.

4 Bill Payment must be set up previously in Online Banking.

Android and Google Play are trademarks of Google, Inc. Apple®, the Apple logo, iPhone®, and iPad® are trademarks of Apple, Inc., registered in the U.S. and other countries. App Store is a service mark of Apple, Inc.